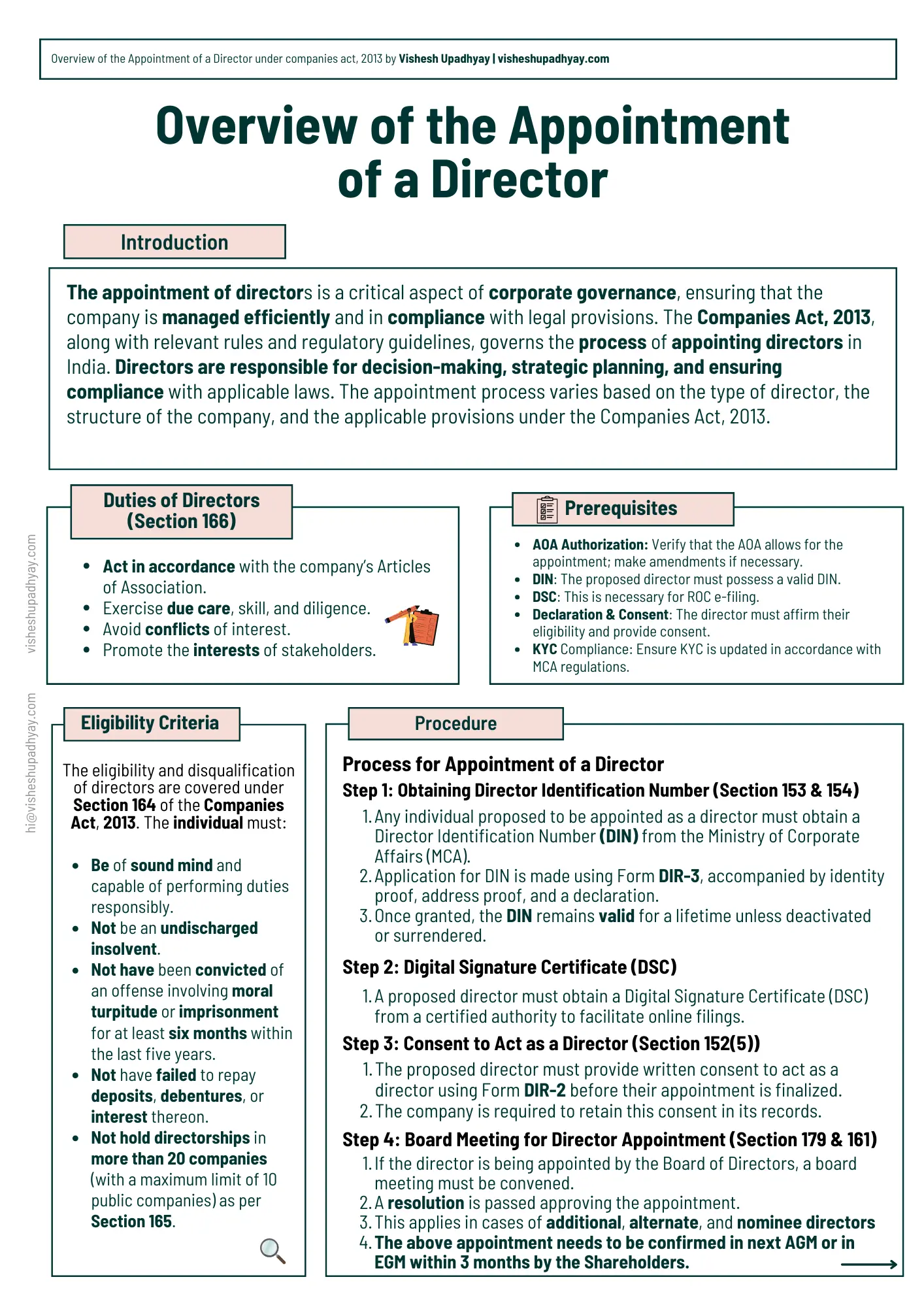

Introduction

The appointment of directors is a critical aspect of corporate governance, ensuring that the company is managed efficiently and in compliance with legal provisions. The Companies Act, 2013, along with relevant rules and regulatory guidelines, governs the process of appointing directors in India. Directors are responsible for decision-making, strategic planning, and ensuring compliance with applicable laws. The appointment process varies based on the type of director, the structure of the company, and the applicable provisions under the Companies Act, 2013.

About this Article

This article discusses the legal and procedural framework governing the appointment of directors under the Companies Act, 2013. It covers key aspects such as the prerequisites for appointment, eligibility criteria, types of directors, and the step-by-step process of appointment. Additionally, it highlights practical challenges, compliance requirements, and the consequences of non-compliance. The article aims to serve as a guide for companies, corporate professionals, and stakeholders involved in corporate governance.

Summarized PDF Infographics

Prerequisites for Appointment of Directors

Before proceeding with the appointment, companies must ensure compliance with the following prerequisites:

- Articles of Association (AOA) Authorization: The company’s AOA must authorize the appointment process. If necessary, amendments should be made before the appointment.

- Director Identification Number (DIN): The proposed director must have a valid DIN issued by the MCA.

- Digital Signature Certificate (DSC): Required for filing electronic forms with the ROC.

- Declaration and Consent: The proposed director must submit a declaration confirming eligibility and consent to act as a director.

- KYC of Director: Updated KYC compliance for all directors, as required under MCA rules.

Eligibility Criteria for Appointment of Directors (Section 164 & 165)

The eligibility and disqualification of directors are covered under Section 164 of the Companies Act, 2013. The individual must:

- Be of sound mind and capable of performing duties responsibly.

- Not be an undischarged insolvent.

- Not have been convicted of an offense involving moral turpitude or imprisonment for at least six months within the last five years.

- Not have failed to repay deposits, debentures, or interest thereon.

- Not hold directorships in more than 20 companies (with a maximum limit of 10 public companies) as per Section 165.

Duties of Directors (Section 166)

- Act in accordance with the company’s Articles of Association.

- Exercise due care, skill, and diligence.

- Avoid conflicts of interest.

- Promote the interests of stakeholders.

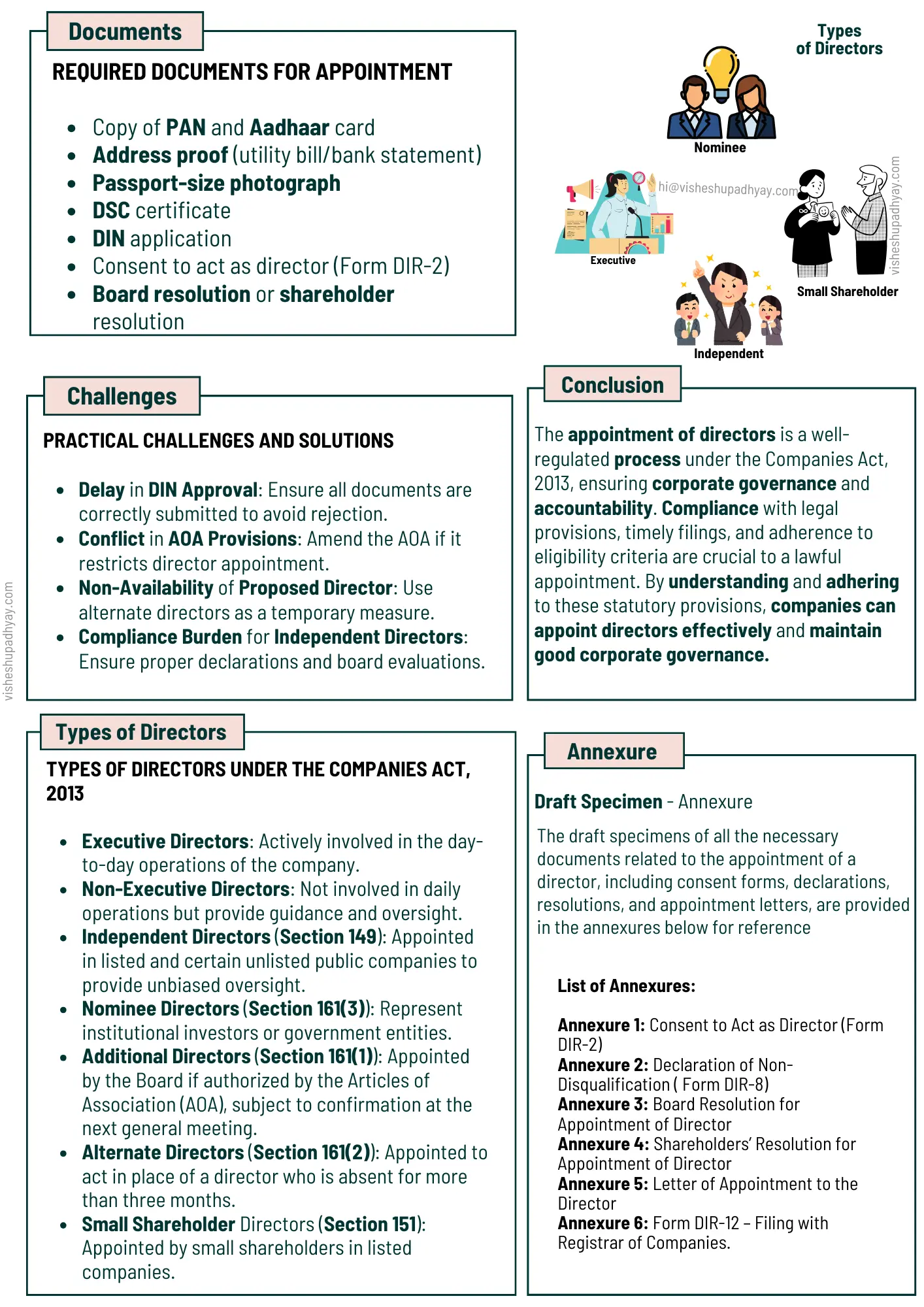

Types of Directors under the Companies Act, 2013

Directors can be classified into various categories based on their roles and responsibilities:

- Executive Directors: Actively involved in the day-to-day operations of the company.

- Non-Executive Directors: Not involved in daily operations but provide guidance and oversight.

- Independent Directors (Section 149): Appointed in listed and certain unlisted public companies to provide unbiased oversight.

- Nominee Directors (Section 161(3)): Represent institutional investors or government entities.

- Additional Directors (Section 161(1)): Appointed by the Board if authorized by the Articles of Association (AOA), subject to confirmation at the next general meeting.

- Alternate Directors (Section 161(2)): Appointed to act in place of a director who is absent for more than three months.

- Small Shareholder Directors (Section 151): Appointed by small shareholders in listed companies.

5. Process for Appointment of a Director

Step 1: Obtaining Director Identification Number (DIN) (Section 153 & 154)

- Any individual proposed to be appointed as a director must obtain a Director Identification Number (DIN) from the Ministry of Corporate Affairs (MCA).

- Application for DIN is made using Form DIR-3, accompanied by identity proof, address proof, and a declaration.

- Once granted, the DIN remains valid for a lifetime unless deactivated or surrendered.

Step 2: Digital Signature Certificate (DSC)

- A proposed director must obtain a Digital Signature Certificate (DSC) from a certified authority to facilitate online filings.

Step 3: Consent to Act as a Director (Section 152(5))

- The proposed director must provide written consent to act as a director using Form DIR-2 before their appointment is finalized.

- The company is required to retain this consent in its records.

Step 4: Board Meeting for Director Appointment (Section 179 & 161)

- If the director is being appointed by the Board of Directors, a board meeting must be convened.

- A resolution is passed approving the appointment.

- This applies in cases of additional, alternate, and nominee directors.

- The Appointment of Director by Board is Required to be Approved by the Shareholders in the Following AGM or within 3 Months( via EGM) Whichever is earlier.

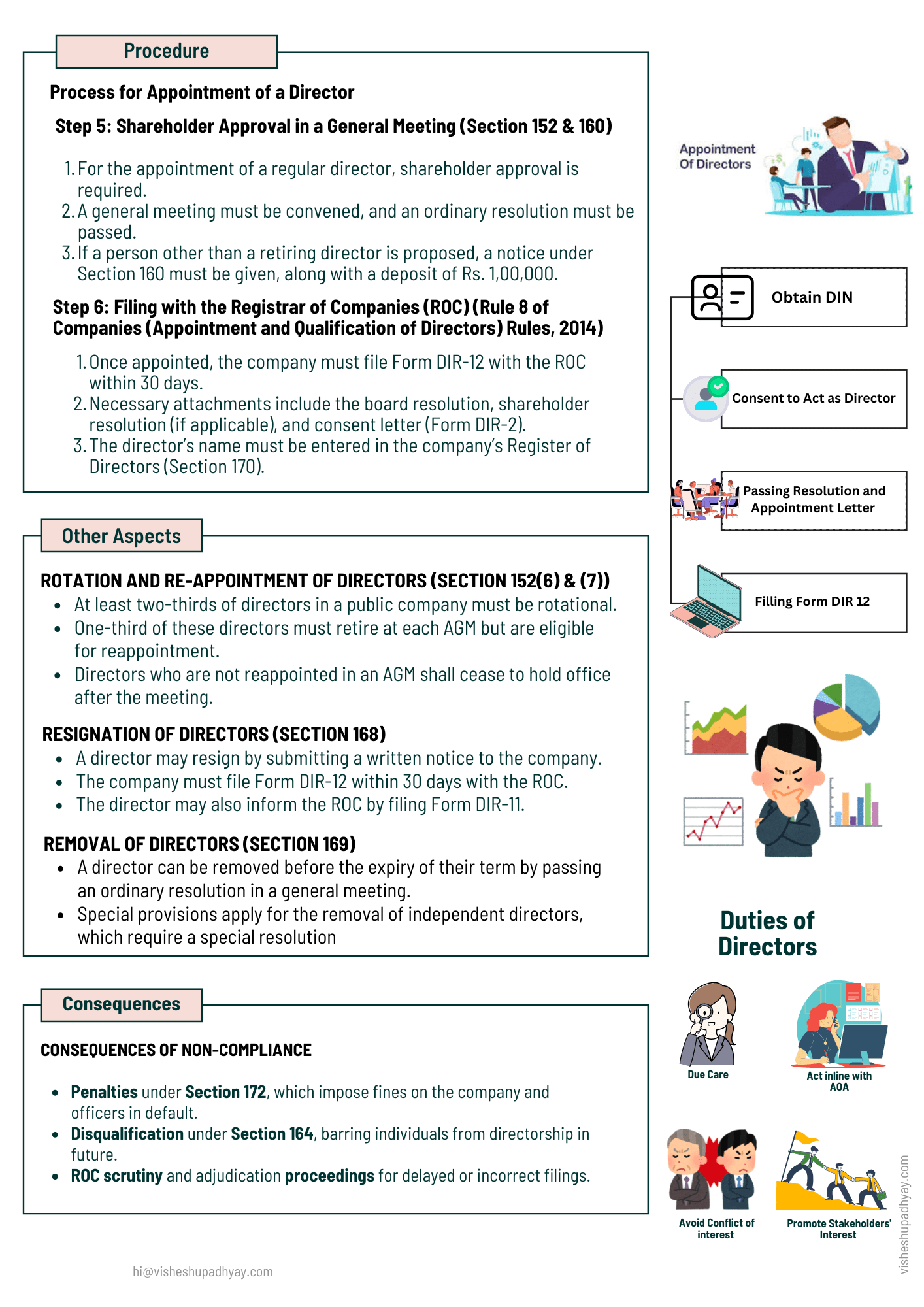

Step 5: Shareholder Approval in a General Meeting (Section 152 & 160)

- For the appointment of a regular director, shareholder approval is required.

- A general meeting must be convened, and an ordinary resolution must be passed.

- If a person other than a retiring director is proposed, a notice under Section 160 must be given, along with a deposit of Rs. 1,00,000.

Step 6: Filing with the Registrar of Companies (ROC) (Rule 8 of Companies (Appointment and Qualification of Directors) Rules, 2014)

- Once appointed, the company must file Form DIR-12 with the ROC within 30 days.

- Necessary attachments include the board resolution, shareholder resolution (if applicable), and consent letter (Form DIR-2).

- The director’s name must be entered in the company’s Register of Directors (Section 170).

Required Documents for Appointment

- Copy of PAN and Aadhaar card

- Address proof (utility bill/bank statement)

- Passport-size photograph

- DSC certificate

- DIN application (if applicable)

- Consent to act as director (Form DIR-2)

- Board resolution or shareholder resolution

Practical Challenges and Solutions

- Delay in DIN Approval: Ensure all documents are correctly submitted to avoid rejection.

- Conflict in AOA Provisions: Amend the AOA if it restricts director appointment.

- Non-Availability of Proposed Director: Use alternate directors as a temporary measure.

- Compliance Burden for Independent Directors: Ensure proper declarations and board evaluations.

Rotation and Re-Appointment of Directors (Section 152(6) & (7))

- At least two-thirds of directors in a public company must be rotational.

- One-third of these directors must retire at each AGM but are eligible for reappointment.

- Directors who are not reappointed in an AGM shall cease to hold office after the meeting.

Removal and Resignation of Directors

1 Resignation of Directors (Section 168)

- A director may resign by submitting a written notice to the company.

- The company must file Form DIR-12 within 30 days with the ROC.

- The director may also inform the ROC by filing Form DIR-11.

2 Removal of Directors (Section 169)

- A director can be removed before the expiry of their term by passing an ordinary resolution in a general meeting.

- Special provisions apply for the removal of independent directors, which require a special resolution.

Consequences of Non-Compliance

Failure to comply with the appointment process can lead to:

- Penalties under Section 172, which impose fines on the company and officers in default.

- Disqualification under Section 164, barring individuals from directorship in future.

- ROC scrutiny and adjudication proceedings for delayed or incorrect filings.

Draft Specimen - Annexure

The draft specimens of all the necessary documents related to the appointment of a director, including consent forms, declarations, resolutions, and appointment letters, are provided in the annexures below for reference.

List of Annexures

- Annexure 1: Consent to Act as Director (Form DIR-2)

- Annexure 2: Declaration of Non-Disqualification ( Form DIR-8)

- Annexure 3: Board Resolution for Appointment of Director

- Annexure 4: Shareholders’ Resolution for Appointment of Director

- Annexure 5: Letter of Appointment to the Director

- Annexure 6: Form DIR-12 – Filing with Registrar of Companies

Download Annexure - Word File - Click here

Annexure 1: Consent to Act as a Director (Form DIR-2)

Form DIR-2

Consent to act as a director of a company

Pursuant to Section 152(5) and rule 8 of companies (Appointment and Qualification of Directors rules), 2014

To,

___ PRIVATE LIMITED

Subject: Consent to act as a Director.

I, Asif Husain, hereby give my consent to act as director of ___ PRIVATE LIMITED pursuant to sub-section (5) of Section 152 of the Companies Act, 2013 and certify that I am not disqualified to become a director under the Companies Act, 2013.

- Director Identification Number (DIN):

- Name (in full):

- Father’s Name (in full):

- Address:

- E-mail id:

- Mobile No.:

- Income-tax PAN:

- Occupation:

- Date of Birth:

- Nationality:

11.No. of companies in which I am already a Director and out of such companies the names of the companies in which I am a Managing Director, Chief Executive Officer, Whole time Director, Secretary, Chief Financial Officer and Manager.

- Particulars of membership No. and Certificate of practice No. if the applicant is a member of any professional Institute. N/A

Declaration

I declare that I have not been convicted of any offence in connection with the promotion, formation or management of any company or LLP and have not been found guilty of any fraud or misfeasance or of any breach of duty to any company under this Act or any previous company law in the last five years. I further declare that if appointed, my total Directorship in all the companies shall not exceed the prescribed number of companies in which a person can be appointed as a Director.

Signature: [Name of Director] [Date]

Attachments:

- Proof of identity;

- Proof of residence;

Annexure 2: Declaration of Non-Disqualification (Form DIR-8)

DECLARATION OF NON-DISQUALIFICATION UNDER SECTION 164(2) (Pursuant to Section 164(2) and Rule 14(1) of the Companies (Appointment and Qualification of Directors) Rules, 2014)

To, The Board of Directors [Company Name] [Company Address]

I, [Name], son/daughter of [Father’s Name], resident of [Address], having Director Identification Number (DIN): [DIN], hereby confirm that:

- I am not disqualified from being appointed as a director under Section 164(2) of the Companies Act, 2013.

- I have not been convicted of any offense and sentenced to imprisonment for a period exceeding six months.

- I am not debarred by SEBI or any other regulatory authority from holding the position of a director.

I affirm that the above declarations are true to the best of my knowledge.

Signature: [Name of Director] [Date]

Annexure 3: Board Resolution for Appointment of Director

[On the Company’s Letterhead]

BOARD RESOLUTION FOR APPOINTMENT OF DIRECTOR

CERTIFIED TRUE COPY OF THE RESOLUTION PASSED AT THE MEETING OF THE BOARD OF DIRECTORS OF [COMPANY NAME], HELD ON [DATE] AT [TIME] AT [VENUE].

“RESOLVED THAT pursuant to the provisions of Section 152 and other applicable provisions of the Companies Act, 2013, and the Articles of Association of the Company, Mr./Ms. [Name], having DIN: [DIN], who has provided his/her consent in writing to act as a director and has submitted the necessary declarations, be and is hereby appointed as a [Designation, e.g., Additional/Independent/Executive] Director of the Company with effect from [Date].”

“RESOLVED FURTHER THAT Mr./Ms. [Authorized Person’s Name], Director/Company Secretary of the Company, be and is hereby authorized to file the necessary forms with the Registrar of Companies and take all such steps as may be required in this regard.”

For and on behalf of [Company Name]

[Signature] [Name] [Designation] [Date]

Annexure 4: Shareholders’ Resolution for Director Appointment

[On the Company’s Letterhead]

ORDINARY RESOLUTION PASSED AT THE GENERAL MEETING

CERTIFIED TRUE COPY OF THE RESOLUTION PASSED AT THE [ANNUAL/EXTRAORDINARY] GENERAL MEETING OF [COMPANY NAME] HELD ON [DATE] AT [VENUE].

“RESOLVED THAT pursuant to the provisions of Sections 152, 160, and other applicable provisions of the Companies Act, 2013, Mr./Ms. [Name], having DIN: [DIN], who has consented to act as a director and meets the qualifications prescribed under the Act, be and is hereby appointed as a [Designation] Director of the Company, liable to retire by rotation/not liable to retire by rotation.”

For and on behalf of [Company Name]

[Signature] [Name] [Designation] [Date]

Annexure 5: Letter of Appointment to Director

[On the Company’s Letterhead]

To, [Name of Director] [Address]

Subject: Appointment as Director of [Company Name]

Dear [Name],

We are pleased to inform you that the Board of Directors of [Company Name] has approved your appointment as a [Designation] Director of the Company in its meeting held on [Date], subject to shareholders’ approval at the upcoming General Meeting.

Your appointment is effective from [Date] and will be governed by the provisions of the Companies Act, 2013, and the Articles of Association of the Company.

We look forward to your contribution to the success of the company.

Yours sincerely, For [Company Name]

[Signature] [Name] [Designation] [Date]

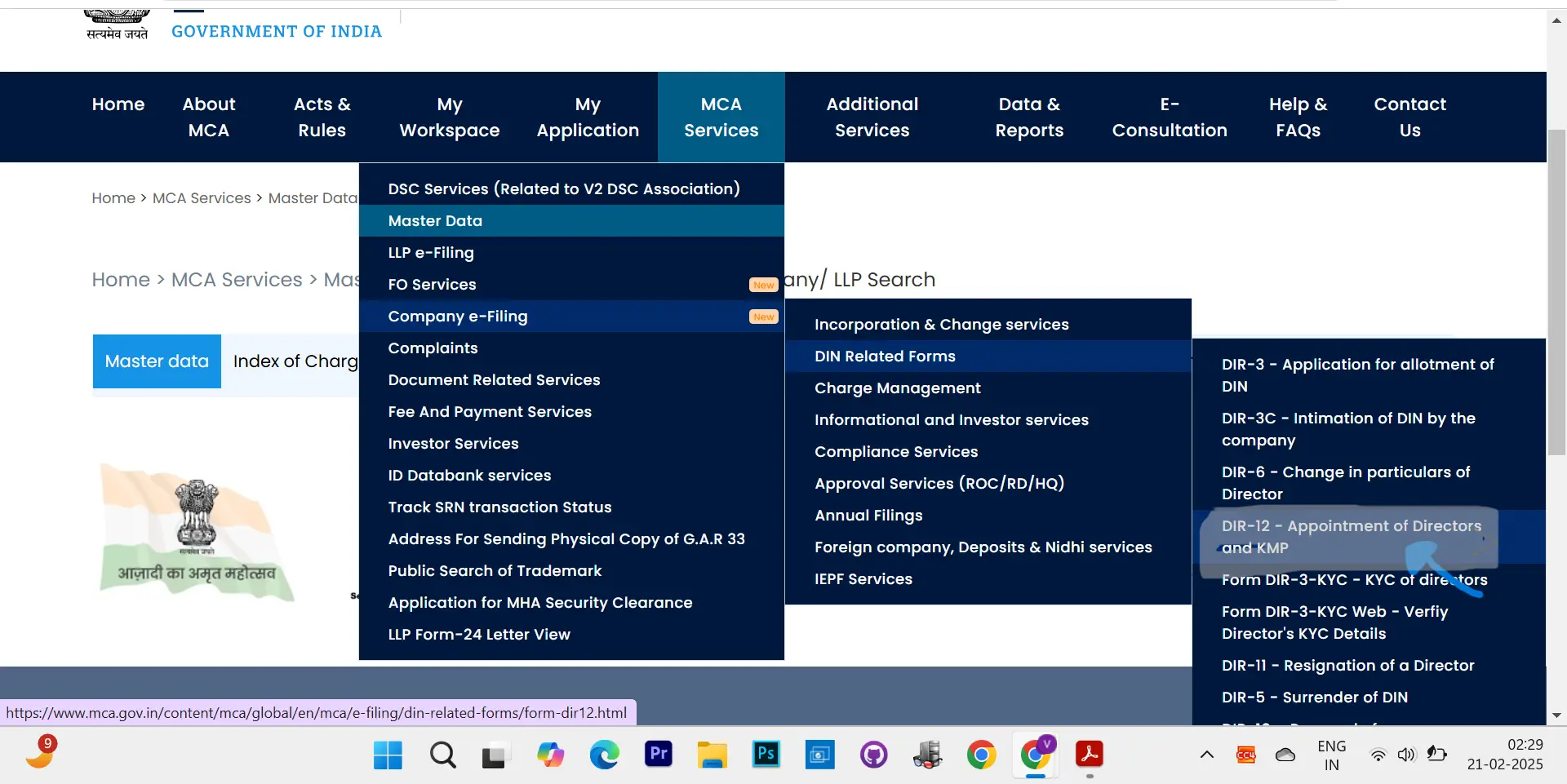

Annexure 6: Form DIR-12 – Filing with Registrar of Companies

This is an e-Form filed with the MCA portal V3 Form DIR 12. The details required include:

- Company Name & CIN

- Director’s Name & DIN

- Type of Appointment

- Board Resolution details

- Attachments: DIR-2, DIR-8, and Board Resolution

MCA PORTAL > COMPANY EFILLLING > DIN RELATED SERVICES > DIR 12

Conclusion

The appointment of directors is a well-regulated process under the Companies Act, 2013, ensuring corporate governance and accountability. Compliance with legal provisions, timely filings, and adherence to eligibility criteria are crucial to a lawful appointment. By understanding and adhering to these statutory provisions, companies can appoint directors effectively and maintain good corporate governance.

##Quiz

Appointment of Directors Quiz

1. Who appoints the first directors of a company?

2. As per the Companies Act, 2013, what is the maximum tenure of an independent director?

3. Which form is required to be filed with the Registrar of Companies for the appointment of a director?

4. What is the minimum number of directors required for a public company?

5. Which of the following is not a type of director under the Companies Act, 2013?

6. What is the minimum age requirement for a director as per the Companies Act, 2013?

7. Which regulatory body oversees the appointment of directors in listed companies?

8. Who appoints an Additional Director in a company?

9. Under which section of the Companies Act, 2013, can a company remove a director?

10. What is the minimum percentage of independent directors required on the Board of a listed company?

Quiz Answers and Explanations

1. Who appoints the first directors of a company?

Correct Answer: The Subscribers to the Memorandum

The first directors of a company are appointed by the subscribers to the memorandum at the time of incorporation.

2. As per the Companies Act, 2013, what is the maximum tenure of an independent director?

Correct Answer: 5 years per term

An independent director can hold office for a maximum term of 5 years, and can be reappointed for another 5-year term, subject to approval.

3. Which form is required to be filed with the Registrar of Companies for the appointment of a director?

Correct Answer: DIR-12

Form DIR-12 is used to notify the Registrar of Companies (ROC) about the appointment or resignation of a director.

4. What is the minimum number of directors required for a public company?

Correct Answer: Three

A public company must have at least three directors as per the Companies Act, 2013.

5. Which of the following is not a type of director under the Companies Act, 2013?

Correct Answer: Shareholder Director

While shareholders may appoint directors, there is no specific designation called 'Shareholder Director' under the Companies Act, 2013.

6. What is the minimum age requirement for a director as per the Companies Act, 2013?

Correct Answer: 18 years

As per the Companies Act, a person must be at least 18 years old to become a director of a company.

7. Which regulatory body oversees the appointment of directors in listed companies?

Correct Answer: SEBI

The Securities and Exchange Board of India (SEBI) regulates the appointment of directors in listed companies to ensure corporate governance.

8. Who appoints an Additional Director in a company?

Correct Answer: Board of Directors

The Board of Directors has the power to appoint an additional director, subject to shareholder approval in the next general meeting.

9. Under which section of the Companies Act, 2013, can a company remove a director?

Correct Answer: Section 169

Section 169 of the Companies Act, 2013, provides the procedure for removing a director before the expiry of their term.

10. What is the minimum percentage of independent directors required on the Board of a listed company?

Correct Answer: 50% (if the Chairman is non-independent)

If the Chairman of a listed company’s board is a non-independent director, then at least 50% of the board must consist of independent directors.